It’s no secret that the stock market had a volatile, yet great year in 2025. Many people ask us why it feels like the stock market is all over the place, but the economy still seems stable? The truth is, there are a lot of factors that go into day to day stock prices, and these prices don’t always coincide with what is actually going on in the economy. So what is going on in the markets and the economy?

Let’s start off with the stock market:

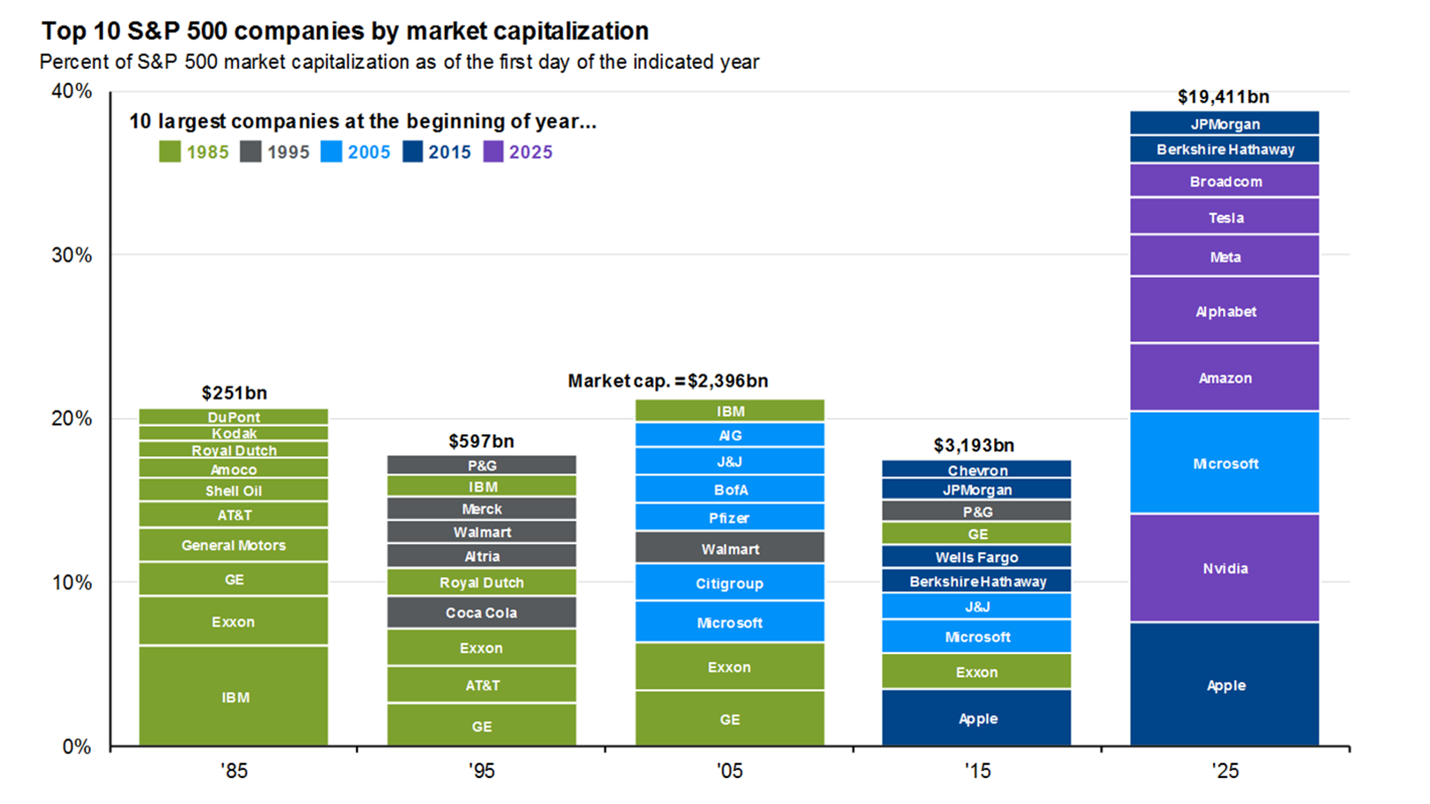

The S&P 500 ended up 17.9% in 2025 including dividends, and even with all the volatility we felt all year, (1). For those who were patient and stayed the course, they benefited from stocks this year. Large U.S. companies have continued to outperform small- and mid-sized companies, leading to greater concentration at the top of the market. Today, the ten largest companies make up nearly 40% of the S&P 500, compared to roughly 20% in 1985. This shift means a relatively small group of companies now represents a significant portion of the index’s total value. The chart below highlights how dramatically market leadership and concentration have changed over time (2).

This chart is a powerful reminder that market leadership evolves over time, and diversification matters more than chasing winners of the past.

Another positive area of the market in 2025 was international. You may remember that at Bloom Wealth Advisors, we went over a decade without being invested in international. We were eager for an entry point for many years and were delighted when we got in in 2022. It paid off this year as international markets were up over 25%, (3). We are currently at our targets for our clients’ accounts in international markets, which is still small at approximately 15%. This is something we continue to monitor and make changes as we see opportunities or threats.

As 2025 is now behind us, we can celebrate what a good year in the market it was, while we also remember that we are long-term investors. We will continue our long-term investment discipline for our clients and make sure each individual portfolio is aligned with our clients’ goals, time horizon and liquidity needs.

Now let’s move on to the economy:

We had quite a ride this year with the economy, interest rate cuts, inflation continuing and a government shut down. In 2025, we had 3 interest rate cuts for a total .75% reduction this year. There are talks that we can assume there will be a few more in 2026, but we will wait and see.

Inflation has continued in certain areas. Take a look at the price changes comparing prices from December 2025 to last year November 2024, (4).

- Food

- Groceries: 1.9% vs 1.8% last year

- Meats: 4.7% vs 2.7%

- Eggs: 36.8% vs -13.2%

- Coffee: 18.8% vs 3.8%

- Baked products (like bread): 2.4% vs 0.4%

- Seated dining (restaurants): 4.3% vs 3.6%

- Groceries: 1.9% vs 1.8% last year

- Energy

- Gasoline: 0.9% vs -3.4%

- Electricity: 6.9% vs 2.8%

- Utilities (piped gas services): 9.1% vs 4.9%

- Core goods (mostly tariff-impacted)

- Furnishings and supplies: 2.6% vs -0.9%

- New vehicles: 0.6% vs -0.4%

- Used cars: 3.6% vs -3.3%

- Prescription drugs: 1.9% vs 1.1%

- Recreational commodities: 0.6% vs -1.5%

- Shelter

- Rents: 3.0% vs 4.3%

- Owners’ equivalent rent: 3.4% vs 4.8%

- Services

- Vehicle repair and maintenance: 6.9% vs 6.2% (3.4% in 2019)

- Pet services: 5.3% vs 6.2% (4.2% in 2019)

- Admissions (theaters, concerts, sports): 2.7% vs 0.6% (1.4% in 2019)

- Personal care services: 4.1% vs 4.8% (2.7% in 2019)

- Laundry/dry-cleaning: 4.3% vs 5.1% (3.8% in 2019)

- Day care and preschool: 4.7% vs 5.9% (3.4% in 2019)

I’ve personally felt this with coffee! I’m sure you’re feeling it in many ways too. It feels like we haven’t gotten any relief on inflation since 2020 and the bummer about inflation is prices really never go back to where they were. If you feel like things are more expensive, you’re right.

Real GDP growth had a rough first quarter, but it rebounded in Q2 and Q3. Its annualized pace of growth over the first 3 quarters of 2025 is 2.5%, which is not as strong of pace as we saw in 2023 and 2024. But overall GDP growth remains consistent, (5).

Okay now, get to the question of the quarter! Why does the stock market sometimes seem disconnected from the economy?

Well, a lot goes into a stock price and stock prices are moving constantly. Ideally, the stock price would be based off of corporate earnings and future expectations of the company. But what also goes into the short term stock prices is investors’ emotions and trading volumes, which can change quickly. This is why even if companies are doing well and on paper everything is on the up and up, sudden consumer fear or big news could change a stock price drastically and quickly.

What is important for you to always remember is that you are a long-term investor. Trying to time the market is IMPOSSIBLE. And paying attention to short term stock prices can get you into trouble. So what’s the best thing you can do? Stay the course, invest consistently and often, and diversify! All things we do on behalf of our clients. We understand that investing can feel emotional. But I assure you, our job at Bloom Wealth Advisors is to not invest on emotions.

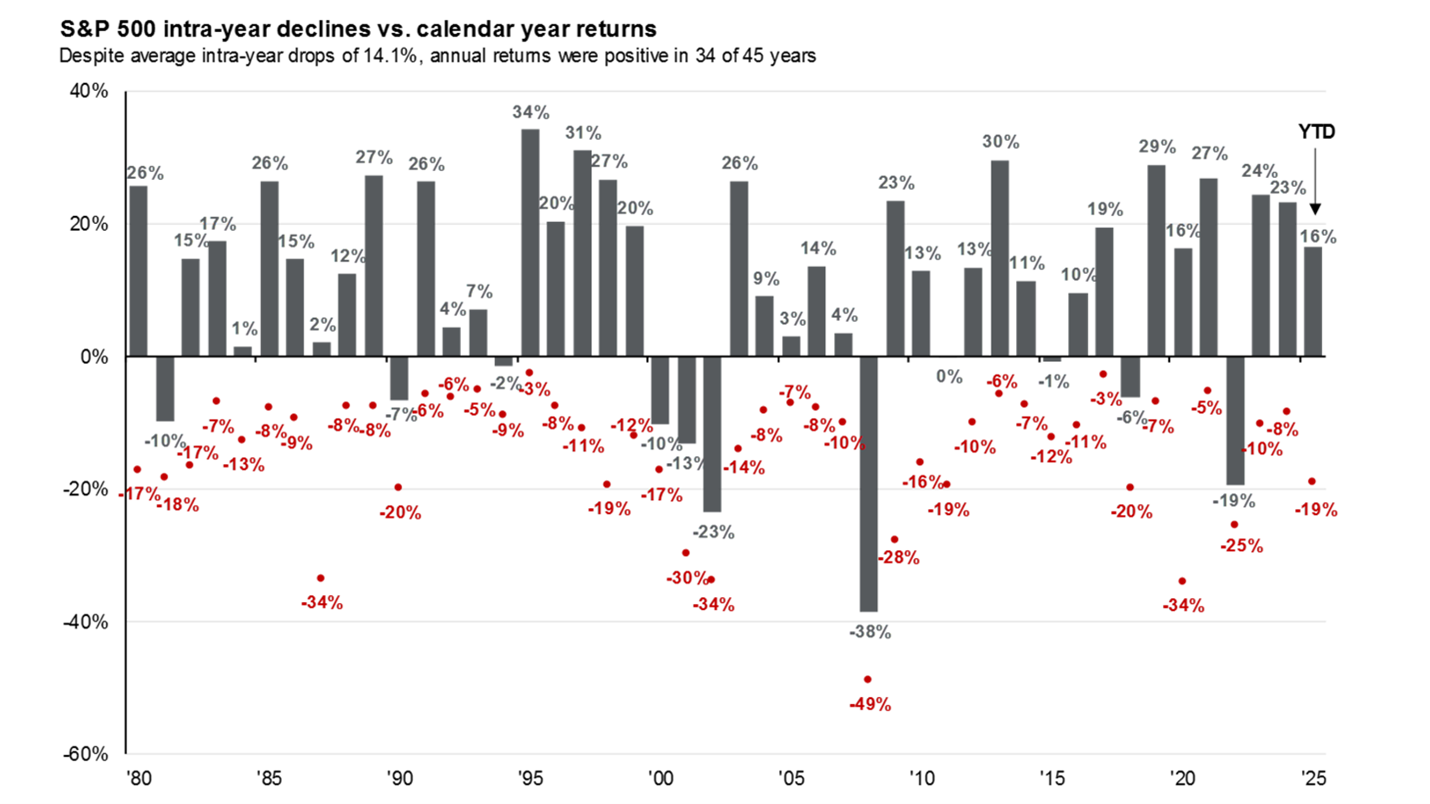

I’ll leave you with one final chart. If you’ve been a client of ours for a while, you’ve probably seen us show this chart. The below chart shows the lowest intra year decline in the S&P 500 in red. And then it also shows the year end calendar return. When this chart was released in November of 2025, the lowest intra year decline was 19%, yet the market still closed out the year at 20% (2). You can also see that the huge majority of the years had a positive year end return, even though many years there were drastic intra year declines. Another point to show you, don’t focus so much on the day to day prices, but over a longer period of time.

Stay the course, you long-term investor!

Now it is more important than ever to be leaning on us and staying the course with us. For our clients, we are always here to answer your questions, concerns or to explain what moves we are making in your portfolios. Remember, investments are just one piece of the puzzle, your wealth has many different important pieces including retirement planning, tax strategy, risk management, legacy plan and so much more. As holistic planners, we want to help make sure your portfolio is aligned with your goals.

And if you are not currently working with us, let’s open the door so we can explain how we can add value to your wealth and life. For 2026, we are accepting 12 new clients, and one spot is already accounted for. Don’t wait to reach out to us and start planning your future together.

We hope 2026 is a healthy, prosperous year for all of us. Serving our clients and building long lasting relationships with each of you is our greatest honor.

Sources:

- Varghese, Sonu. January 2nd, 2026. Jan 2- 2025 Markets

- https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

- https://investor.vanguard.com/investment-products/mutual-funds/profile/vtiax#performance-fees

- Varghese, Sonu. December 31st, 2025 Dec 31-FOMC Minutes, Fed Expectations, Home Prices

- Varghese, Sonu. December 30th, 2025. 7 Charts From An Outstanding Q3 GDP Report