What does a government shut down mean? And how are we investing through it?

At the time I’m writing this Question of the Quarter, the U.S. government has been shut down since Congress missed the October 1st funding deadline. By the time you read this, who knows, the government shutdown could be long behind us, as that happens often. However, we’ve had many clients concerned about what a government shut down means for them and their portfolio, and we hope we can provide you some education and guidance on government shutdowns.

Practically speaking, a government shutdown happens when Congress fails to pass laws to provide government funding to government agencies and programs. When this happens, non-essential federal services stop operation, employees can be furloughed without pay and only essential services like national security, air traffic control and emergency services continue. We often see government shutdowns cause delays, worker shortages, delayed filings or reporting.

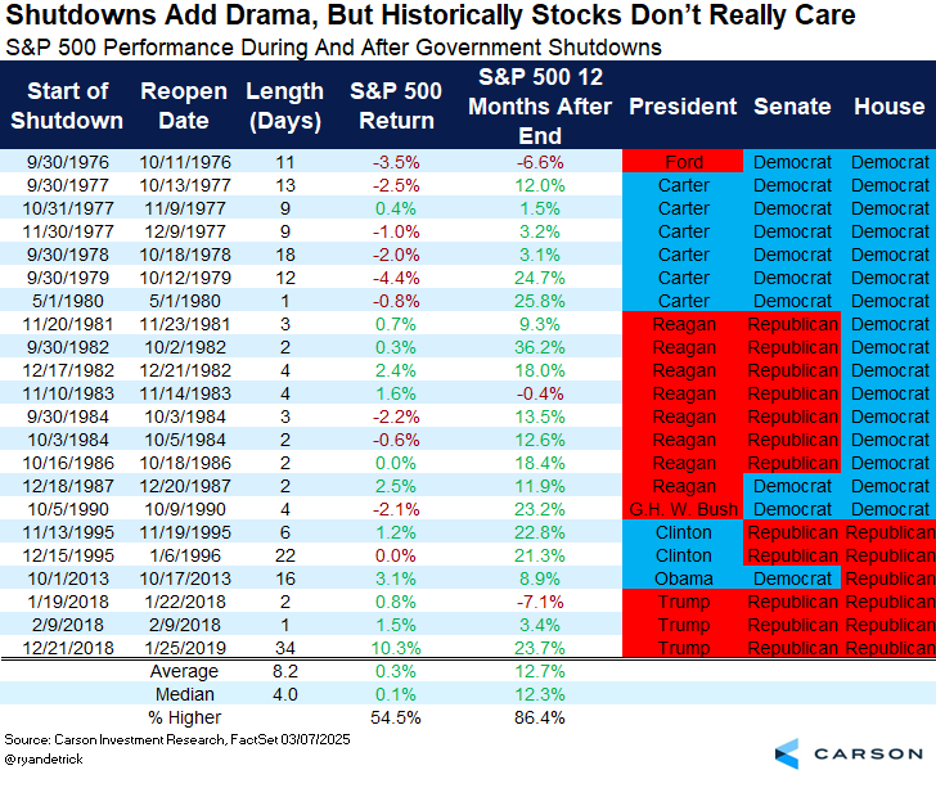

How often does this happen? Since 1981, there have been four major government shut downs including the longest one in 2019 of 34 days. These aren’t new and they do happen somewhat often. (1).

What about markets? Historically, shutdowns create headlines and sometimes short-term volatility, but the longer-term market impact has been limited. Across past shutdowns, stocks have often looked through the noise and were frequently higher three to six months later. In fact, back in 2019 during the 34 day shut down, stocks gained more than 10%! That doesn’t mean markets will repeat history exactly, but it’s a helpful reminder that markets tend to focus on fundamentals like growth, earnings, inflation, and interest rates.

Below is a table we put together that shows how the S&P 500 was up a little bit during the previous 22 shutdowns, and a year later was higher 19 times and up an average of nearly 13%. Now, each time is different and we don’t recommend this as guide on how you invest, but it’s nice to have some perspective on what’s happened historically amid Washington dysfunction. What could make it different this time? A very extended shutdown with no sign of movement at all. But keep in mind that even when there’s a lot of hard bargaining, when this type of political dispute resolves it tends to resolve quickly (2).

What we’re doing at Bloom Wealth Advisors

- Sticking to a disciplined strategy: Your portfolio is built from your personalized Wealth Plan, with a diversified asset mix, aligned with your risk tolerance and goals. We don’t rewrite that plan because of a news cycle. If volatility continues during the shutdown, we will continue actively managing your accounts and rebalancing as needed. Rebalancing will keep risk aligned with your goals rather than with all the noise.

- Managing cash needs intentionally: For clients drawing from portfolios, we utilize a bucketing strategy, where we have your short-term cash needs in a liquid, safe bucket. And anything you need for the long-term can be investment for the future. This allows us not to have to sell long-term investments during volatility. For those in the wealth accumulation phase, we encourage you to keep investing on a consistent and regular basis, regardless of what today’s price is.

- Staying tax smart: Periods of volatility can create opportunities for tax-loss harvesting in taxable accounts, where you offset gains with losses to help eliminate or reduce your tax bill. Sometime volatility brings opportunity. What you can do

- Avoid investing on emotions: Jumping in or out based on headlines is the surest way to turn volatility into a permanent loss.

- Keep contributions on: For retirement plans and other automatic savings, consistency is the most important thing you can do when building wealth.

- Let us know if you have big upcoming expenses: If you have upcoming big-ticket needs, make sure you let us know so we can manage your cash needs proactively.

- Lean on your plan and us: Remember, your Wealth Plan is the foundation of your wealth and we are carefully adjusting your plan over time as your goals and needs change. Short-term market volatility will not alter how we manage your plan going forward. We are here to support you and provide guidance during all these uncertain times.

Government shutdowns can be frustrating and disruptive, but they’re not a new risk and they rarely impact long-term investors. We’ll continue to execute our strategy with discipline, rebalancing thoughtfully, managing taxes, and keeping your plan aligned with your goals, regardless of what’s happening in the market, the economy, or in Washington. If you have questions about your specific situation, we’re here.

Warmly,

Alana Macy, CFP®, MBA, Partner, Wealth Advisor

Source:

- https://www.pgpf.org/article/a-brief-history-of-us-government-shutdowns-and-whyother-countries-do-not-have-them/

- https://www.bloomwealthadvisors.com/insights/blog/market-commentary-whatsimportant-amid-a-shutdown-morass-market-momentum-and-a-missing-jobs-report/.

This information is not intended to provide specific legal, tax or other professional advice. For a comprehensive review of your personal situation, always consult with a tax or legal advisor.