Every election year we get many questions and concerns around the markets. Election years bring heightened uncertainty and speculation, and typically the market doesn’t like uncertainty. As an investor, it is important you understand how elections can impact the stock market to make informed investment decisions. Let’s delve into the historical trends and patterns of the stock market during election years to gain insights into what investors might expect.

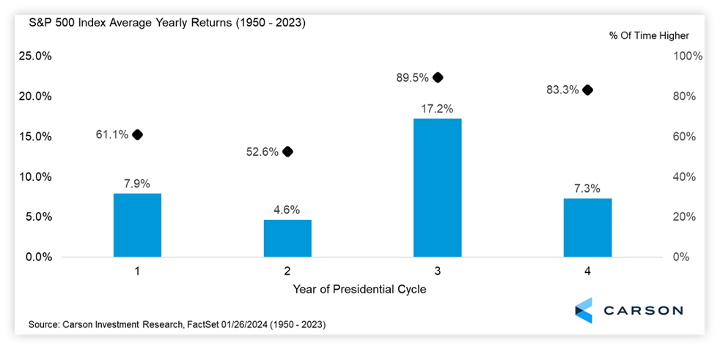

Pre-election years tend to be the strongest out of the four-year term presidency, as you can see from the chart below which shows the S&P 500 average yearly returns. Looking at history, the S&P 500 has historically returned an average of 17.2% in pre-election years in comparison to election years of 7.3%.

Even though election years bring uncertainty, you can see that on average, an election year historically has had positive returns. Of course, there are the outliers like 2000 and 2008. When the market does rally in election years, we typically see it rallying at the end of the year. The first quarter of an election year is typically the worst, however this year, the S&P 500 had a positive return of about 10% for Q1.

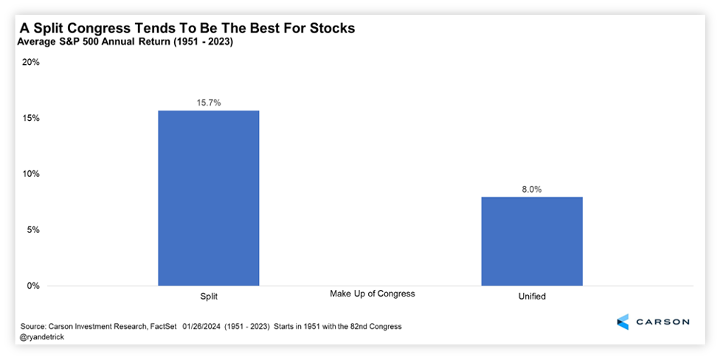

Another factor in how markets handle elections is whether we have a split congress or not. The past shows us that a split Congress has been better for investors. In fact, the past 13 years that had a divided Congress saw the S&P 500 finish higher.

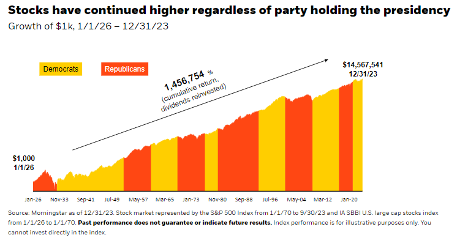

Regardless of your political beliefs, it is important to remember that the stock market is made up of companies, and companies are going to try to find ways to make money regardless of who is in office. And you can see this from the chart below how stocks have continued to climb over the long-term through both Democrat and Republican presidents.

Source: https://www.blackrock.com/us/financial-professionals/insights/investing-in-election-years

While elections can create short-term volatility in the stock market, it’s essential to focus on the long-term trends. Over the long term, the stock market has demonstrated a remarkable ability to recover from short-term volatility and deliver positive returns. We at Bloom Wealth Advisors are always here to remind you that you are a long-term investor. An important part of our job is to not invest on emotions, and this is especially true during election years. We have a long-term plan in place, and we stay the course of our plan even through market uncertainty, political turmoil, or whatever else is thrown our way. If you have questions or concerns, we want to hear from you. Please reach out to us so we can further support you.

Warmly,

Alana Macy, CFP®, MBA | Wealth Advisor