Alana Macy CFP®️️️, MBA Wealth Advisor

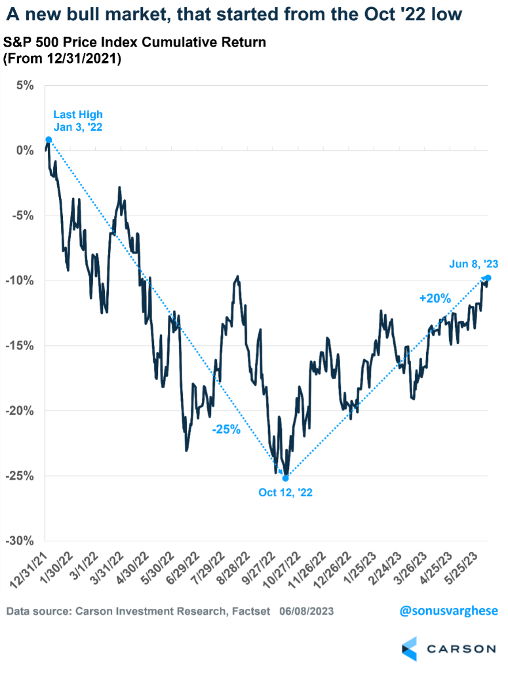

We’ve been on a wild ride the last 3 years, with increased market volatility, a global pandemic, a housing boom, political turmoil and rising inflation. If you didn’t know, we have actually been out of a bear market for 8 months now. The market bottomed in October of 2022 when it was down more than 25%. Since then, we’ve entered a bull market and the S&P 500 has soared in 2023, up 16% as of June 30, 2023. However, remember: market volatility is a normal part of investing.

Along with other bullish signs, we’ve experienced new 52-week highs and 8 months without reaching new lows. The good news is that when stocks go more than 8 months without a new 52-week low, the likelihood of future new lows drops precipitously. In fact, after 8 months of no new lows, more than 80% of the time the S&P 500 has been higher by more than 15%.

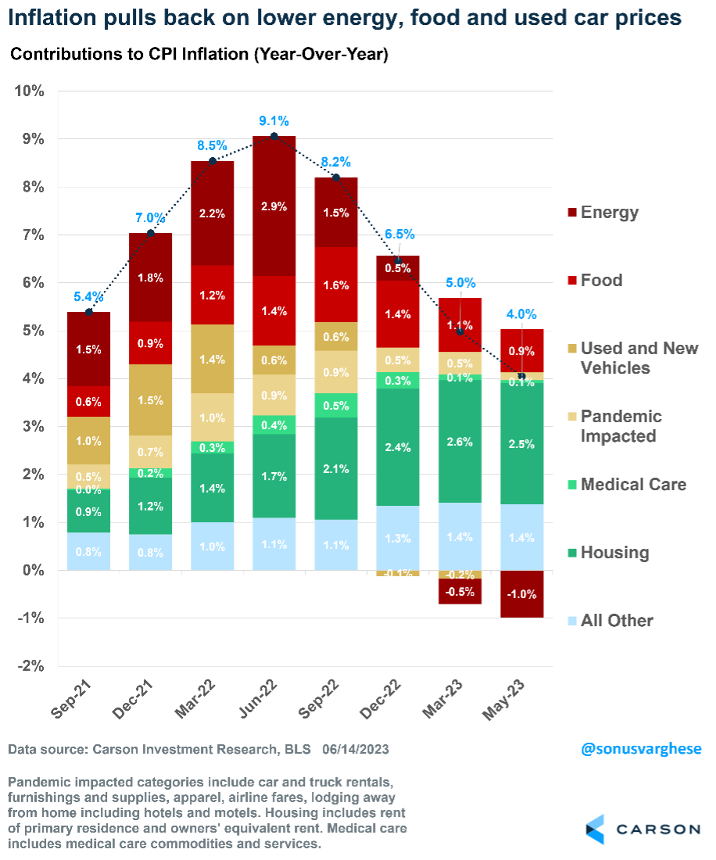

There is also some good news with inflation. If you recall, inflation peaked back in June 2022 at 9.1%. As of now, inflation is finally coming back to earth. Over the last three months, inflation has run at a 2.2% annualized pace, the slowest 3-month pace in over 2 years. Energy prices as well as food prices (finally) have been falling. The Fed is now predicting that we can lower inflation without a recession, which is very good news.

There is also good news with interest rates. The Fed didn’t raise interest rates in June and this is the first time the Fed refrained from increasing rates during a meeting since March of 2022. There may be more rate hikes in the future, and members of the Fed are predicting rates to be at 5.6% by the end of this year.

As always, we at Bloom Wealth Advisors are always watching the markets and recent trends. We are long-term investors and we take the emotion out of investing. If you have questions or concerns, we are always here to talk with you about the markets or anything else on your mind.

The views stated in this letter are not necessarily the opinion of Cetera Advisor Networks LLC and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 – A capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.